by Terry MacCauley - Posted 9 hours ago

Why This Matters Right Now

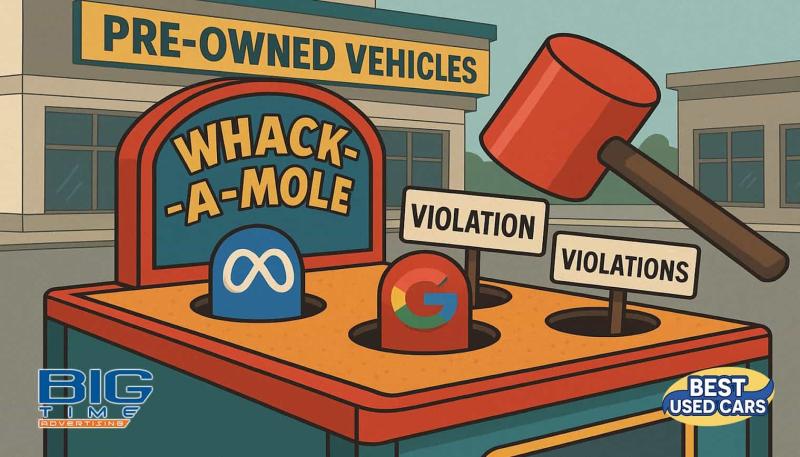

As I write this, Big Time Advertising & Marketing is on the ground in Las Vegas, splitting time between the BHPH United Summit and Compliance Unleashed. Yesterday, I had the chance to present a topic hitting dealers hard: what happens when advertising and compliance collide. The room was full, the questions came fast, and one thing was crystal clear there is a lot of confusion and concern about how compliance plays into running Meta and Google ads. Dealers want to advertise smarter, safer, and without the fear of getting accounts shut down over things they didn’t even know were violations. So today, I’m diving deeper. This blog guides you in navigating those complexities and keeping your digital ad game strong without stepping on any landmines. Let’s go.

If you are pouring money into Meta (Facebook) and Google ads to drive traffic to your dealership, you are not alone. These platforms are game-changers for reaching customers, but they come with a catch: complex rules and policies that can trip you up. From salespeople boosting posts to finance targeting gone wrong, and even legal restrictions like retargeting with pixels in certain states, there are plenty of ways your ad accounts can get paused or shut down permanently. This newsletter breaks down the risks, explains why accounts get flagged, and gives you practical tips to check your accounts and stay compliant all in a straightforward, conversational way. Let’s dive in and keep your ads running smoothly.

Running ads on Meta and Google is like driving a high-performance car: powerful, but you need to know the rules of the road. Here is why dealers often see their accounts paused or shut down:

Google has strict rules, and one big change hit dealers in 2020. Starting October 19, 2020, Google banned ads that mention financing, credit, or pricing details if they use zip code targeting in the US and Canada (Google Ad Policy). Why? To protect consumers from misleading ads, especially in sensitive areas like finance. If your ad mentions “0% APR” and targets specific zip codes, it could get flagged, leading to account restrictions. Even worse, if your website mentions credit services anywhere, this policy might apply, catching dealers off guard.

Meta’s no stranger to shaking things up. In 2023, they dropped a bombshell: starting January 30, 2023, dealerships can no longer list vehicles on Facebook Marketplace from business pages (Meta Marketplace Changes). You now have to buy ads or post from personal accounts, which can confuse dealers and lead to policy violations if not handled correctly. Plus, Meta’s “automatic adjustments” feature can tweak your campaigns without your consent, pausing ads or changing budgets, potentially disrupting your strategy (Meta Adjustments).

Both platforms share some universal red flags that can tank your account:

Repeated Declined Payments: If your payment method keeps failing, you might get flagged as a “bad debtor” (Meta Ad Issues).

Low Page Quality: Posting content that violates community guidelines (e.g., misleading claims) can lower your page score and risk a ban.

Poor Ad Quality: Ads with clickbait, too much text over images, or low relevance can get disapproved or slow approvals.

Subpar Landing Pages: Pages with pop-ups, broken links, or misleading info can trigger violations.

Policy Violations: Repeatedly breaking rules, like improper targeting or restricted content, can lead to permanent shut downs.

Picture this: your sales team sees a shiny new car on the lot and decides to boost a post on Facebook to show it off. Sounds great, right? Not so fast. Boosting posts is a quick way to promote content, but it’s like using a sledgehammer when you need a scalpel. Here is why it can cause trouble:

Boosted posts mainly reach your page’s followers and their friends, which might not be your ideal buyers (Boost Post Issues). Unlike full ad campaigns, you cannott retarget website visitors, use lookalike audiences, or exclude irrelevant groups. If your page has only a few hundred likes, your reach is tiny, wasting your ad budget.

When you boost a post, Meta defaults to “Page Post Engagement,” optimizing for likes, shares, and comments not sales or leads. For dealers, you want conversions, like form submissions or dealership visits. Boosted posts rarely deliver on these goals, making them less effective.

If a boosted post includes restricted content like financing details or misleading claims it can get disapproved, racking up policy violations. Salespeople might not know Meta’s ad rules, increasing the risk of account flags.

Instead of boosting posts, use Meta’s Ads Manager to create full campaigns. You will get advanced targeting, better objectives (like conversions), and more control over placements (e.g., Instagram Stories, Messenger). It takes a bit more effort, but it is worth it to avoid wasted spend and policy headaches.

Advertising financing options are a must for dealers, but it is a minefield of rules, especially on Google. Here’s what you need to know:

Google’s policies for financial products are harsh (Google Finance Policy). If your ad mentions financing or credit, you can’t use zip code targeting, and you must include clear disclosures, like:

Your dealership’s physical address.

Any fees or third-party accreditations

Terms like minimum/maximum repayment period and APR (if applicable).

Car loans are technically excluded from Google’s personal loans policy, but if your website mentions credit services, you might still get flagged (Reddit Post). Some dealers report ads being incorrectly flagged for “consumer finance” even without financing details, suggesting Google’s review system can be overly sensitive.

Meta also requires compliance with financial ad rules, ensuring ads aren’t misleading and include necessary disclosures. For example, you cannot imply “everyone qualifies” for financing without clear terms. Violations can lead to ad disapprovals or account issues.

Avoid Zip Code Targeting: On Google, use radius-based targeting for finance ads to comply with the 2020 policy.

Clear Disclosures: Include all required information in your ads and landing pages.

Audit Content: Regularly check your website and ads for anything that might trigger finance-related flags.

Appeal Flagged Ads: If ads are incorrectly flagged, appeal through Google’s support channels or verify your account via the Financial Services Verification form.

Retargeting, showing ads to people who visited your website, is a powerful tool, but state laws can throw a wrench in your plans. Here is a big one to watch:

Since January 1, 2020, California’s CCPA has limited how dealers can use pixel-based retargeting on Meta (CCPA Impact). CCPA restricts how personal data can be shared, making pixel-based Custom Audiences less effective for California users. Meta implemented changes to comply, meaning retargeting ads might not deliver at all or perform poorly. For example, a California dealer’s retargeting campaign might fail to reach bottom-of-the-funnel buyers, hurting conversions.

To work around this, Meta introduced the Limited Data Use (LDU) feature in July 2020, letting dealers specify when data should be processed under CCPA rules. This can help, but it’s not a full fix for dynamic retargeting.

While California’s CCPA is the most prominent, other states have their own advertising and privacy laws. For instance, New York has guidelines to prevent deceptive auto ads (NY AG Guidelines). Some states also regulate add-ons or hidden fees, which can affect how you structure ads (FTC CARS Rule).

Use LDU on Meta: If you’re in California, enable the Limited Data Use feature to improve retargeting while staying CCPA-compliant.

Broad Audiences: Run broader ad sets without heavy reliance on retargeting in restricted states.

Stay Informed: Check state-specific advertising laws to ensure your ads comply.

Nobody wants to wake up to a suspended ad account. Here’s how to keep your accounts in good standing:

Ads Policy Center: Visit Google’s Ads Policy Center to review policies and check for warnings (Google Policies).

Account Health: Regularly log into your Google Ads account to monitor performance and address any flagged issues.

Verification: If flagged for finance ads, complete the Financial Services Verification form to prove compliance (Reddit Post).

Appeals: If ads are incorrectly flagged, appeal through Google’s support channels or contact the helpdesk.

Business Help Center: Use Meta’s Business Help Center to stay updated on policies and troubleshoot issues (Meta Help Center).

Ads Manager: Check your account status and ad performance in Ads Manager. Look for policy violation notices.

Tools: Use Meta’s Sharing Debugger to ensure landing pages comply (Sharing Debugger) and the Image Text Check tool to avoid text-heavy ads (Image Text Check).

CCPA Compliance: In California, enable the Limited Data Use feature for retargeting (CCPA Impact).

Audit Content: Regularly review ads and landing pages to ensure compliance with platform policies.

Train Your Team: Educate salespeople on the risks of boosting posts and the benefits of Ads Manager.

Clear Disclosures: Include all required info in finance ads, like terms and fees.

Stay Legal: Monitor state laws, like CCPA, and adjust strategies as needed.

Hire Experts: Consider working with a digital marketing agency to navigate complex rules.

Managing Meta and Google ad accounts is no walk in the park, but it is doable with the right knowledge. From policy violations to salespeople boosting posts, finance targeting challenges, and legal restrictions like CCPA, there are plenty of ways to stumble. By understanding these risks, regularly checking your accounts, and following best practices, you can keep your ads running and your dealership thriving. Stay proactive, keep learning, and don’t let a suspended account slow you down!

Just last quarter, a dealer came to us in full panic mode. Their Meta ad account had been shut down overnight, all because a salesperson boosted a post that mentioned “guaranteed approval.” One phrase, one click, and two weeks of lost traffic. It was not intentional, but it did not matter. The platform saw a violation, and the lights went out. This is the kind of mistake we can avoid when we know the rules and stay on top of our compliance game.

To help, here is a quick compliance checklist you can use today:

✅ Avoid zip code targeting when mentioning financing (Google)

✅ Clearly list terms, fees, and dealership info in finance-related ads

✅ Don’t boost posts with restricted language—use Ads Manager instead

✅ Keep landing pages clean: no pop-ups, broken links, or misleading content

✅ Turn on Meta’s Limited Data Use if you're advertising in California

If you are unsure where your dealership stands or want a second set of eyes, we have got you. Big Time Advertising can do a quick compliance check on your ad accounts or train your team so everyone knows the dos and do nots.

This stuff is tricky, no doubt. But the good news? You don’t have to go it alone. We’re in your corner to help keep your campaigns alive, effective, and on the right side of the rules.

Let’s keep your ads running and revenue rolling. You know where to find us.

-by Terry MacCauley, Founder & CEO